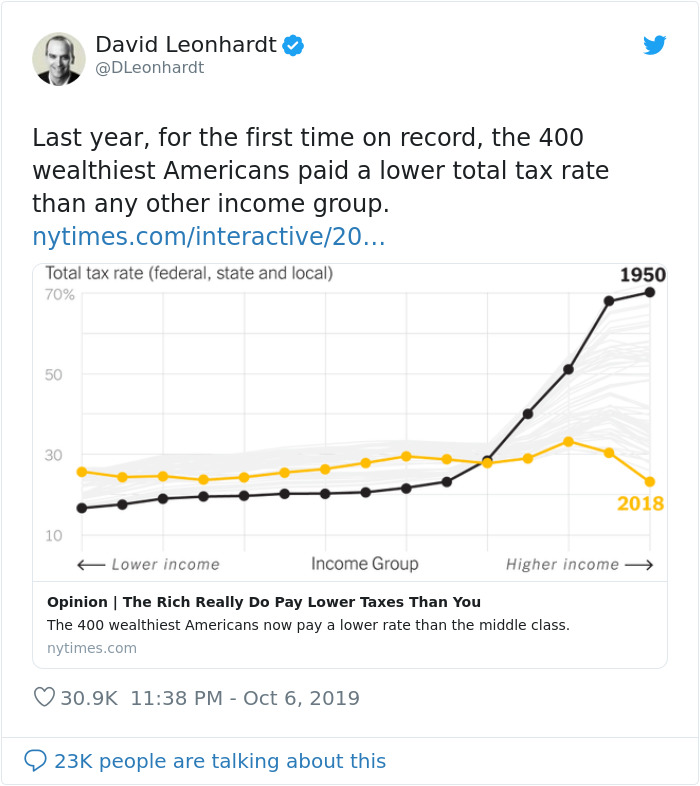

Is the tax system fair? The answer depends on who’s giving it. If it were the 400 wealthiest Americans, they’d probably say yes. Last year, for the first time in recorded history, they paid a lower total tax rate — spanning federal, state and local taxes — than any other income group, according to an article by David Leonhardt. Published on The New York Times, it provides an in-depth explanation of how this came to be.

Image credits: istockphoto / Tom Merton

Image credits: DLeonhardt

“The overall tax rate on the richest 400 households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income. This overall rate was 70 percent in 1950 and 47 percent in 1980,” Leonhardt wrote. “For middle-class and poor families, the picture is different. Federal income taxes have also declined modestly for these families, but they haven’t benefited much if at all from the decline in the corporate tax or estate tax. And they now pay more in payroll taxes (which finance Medicare and Social Security) than in the past. Overall, their taxes have remained fairly flat.”

Watch how radically taxes on the wealthy have fallen over the past 70 years:

(Full column: https://t.co/XP0a4Iljti) pic.twitter.com/dGxmOjQ1b5

— David Leonhardt (@DLeonhardt) October 7, 2019

The data provided by Leonhardt comes from a book on government policy, called The Triumph of Injustice. The authors, Emmanuel Saez and Gabriel Zucman, are professors at the University of California, Berkeley, and have done quite a lot of work on taxes. “Saez has won the award that goes to the top academic economist under age 40, and Zucman was recently profiled on the cover of Bloomberg BusinessWeek magazine as ‘the wealth detective,'” Leonhardt explained.

“They have constructed a historical database that tracks the tax payments of households at different points along the income spectrum going back to 1913, when the federal income tax began. The story they tell is maddening — and yet ultimately energizing.”

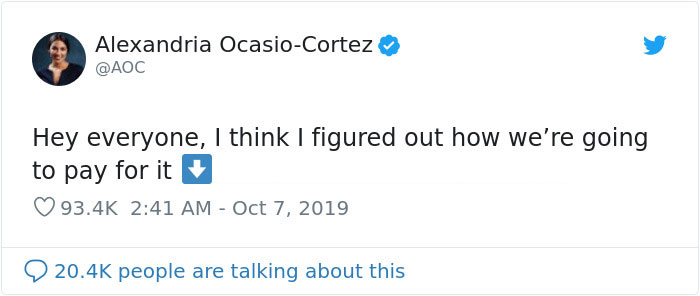

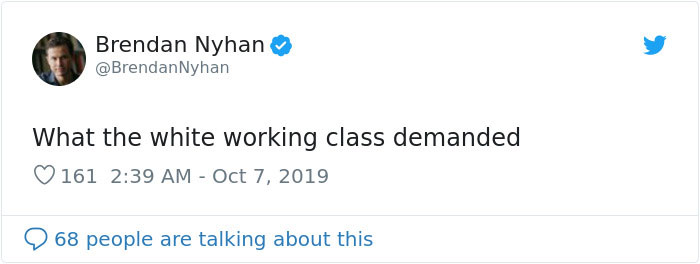

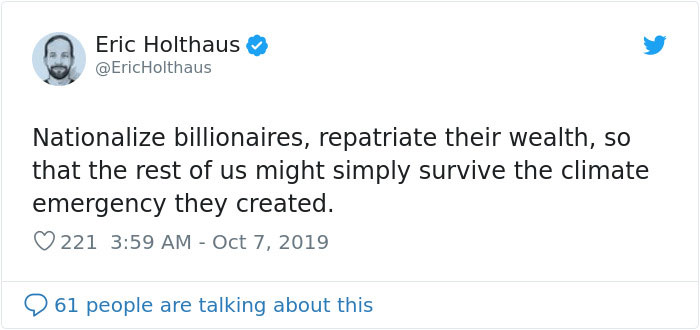

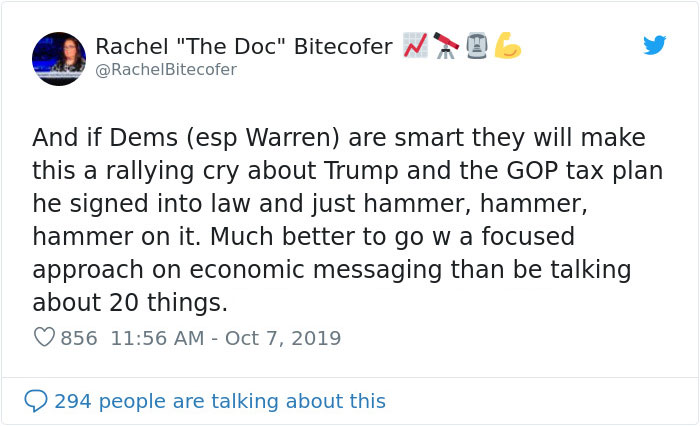

People reacted to these findings in a lot of different ways

Image credits: jonlovett

Image credits: JamesGleick

Image credits: Cryptoterra

Image credits: Patbagley

Image credits: BrendanNyhan

Image credits: LailaLalami

Image credits: EricHolthaus

Image credits: InternetHippo

Image credits: RachelBitecofer

Image credits: BHabshey

Image credits: parrhizzia

Image credits: bizarrojack

Image credits: CBHutcheson

Image credits: HarPurNi

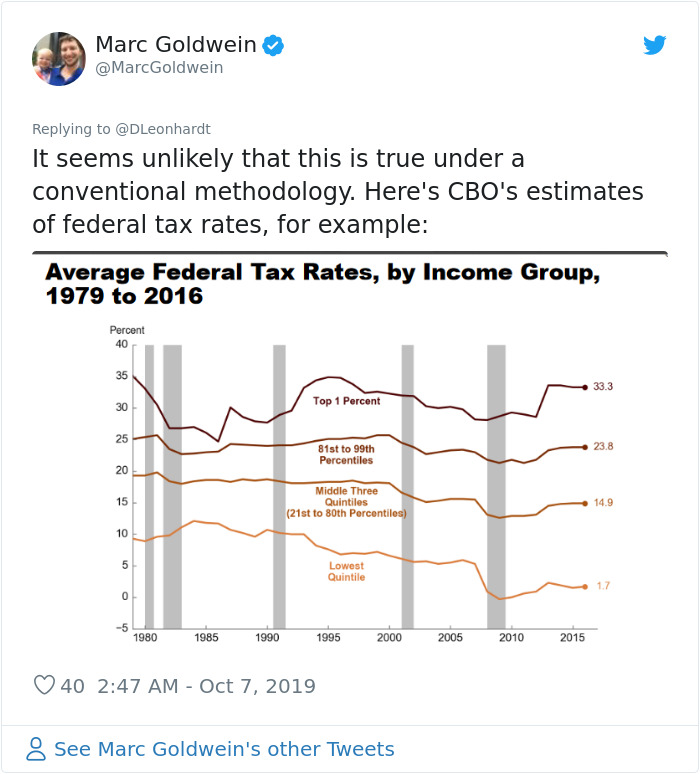

Image credits: MarcGoldwein

Image credits: geoffreysperl

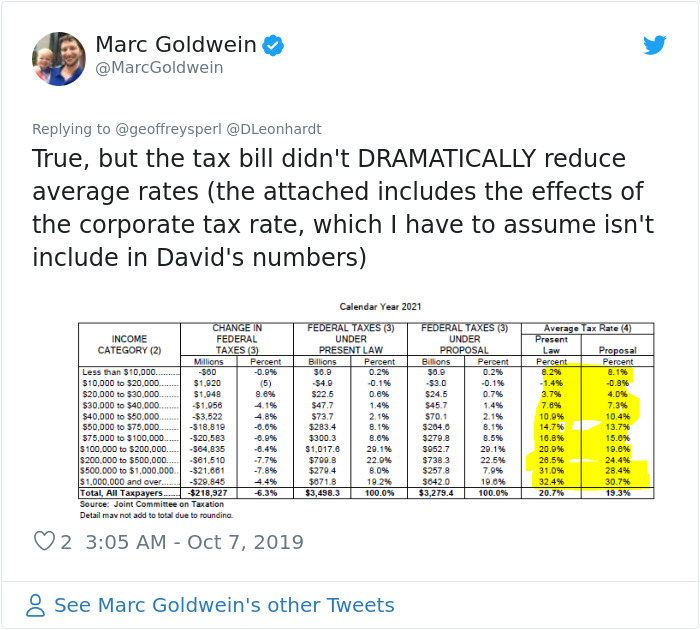

Image credits: MarcGoldwein

Image credits: JGrossund

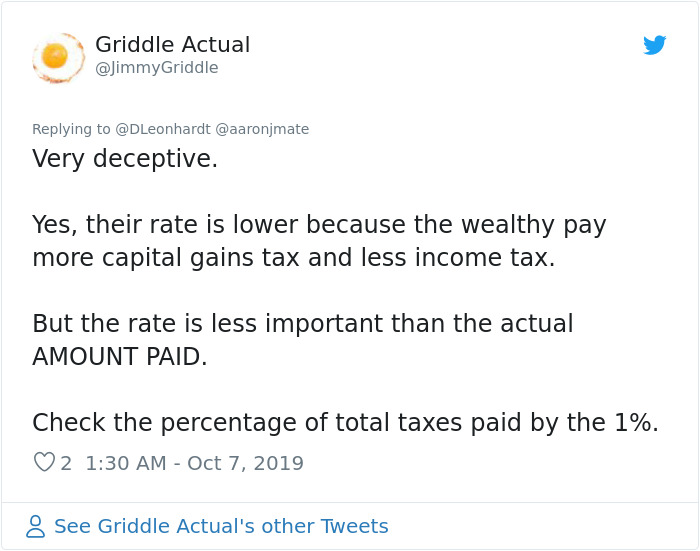

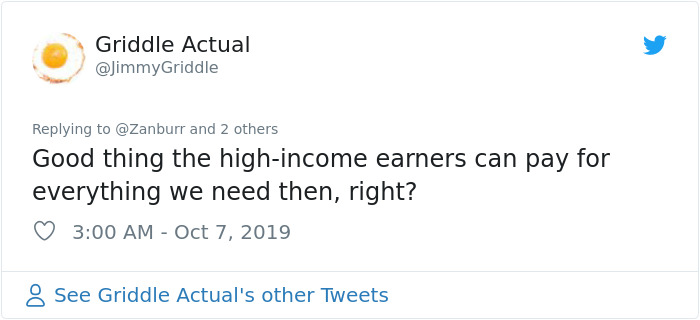

Image credits: JimmyGriddle

Image credits: Zanburr

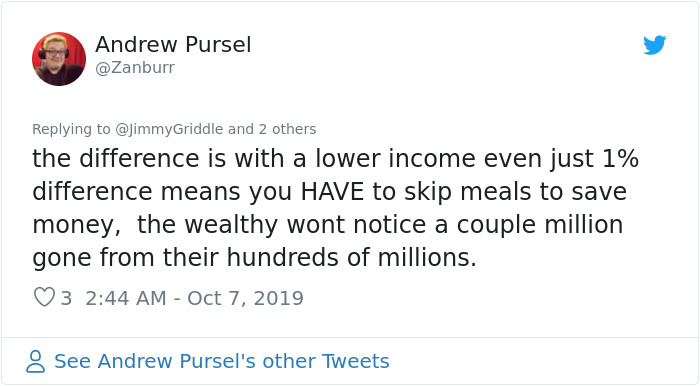

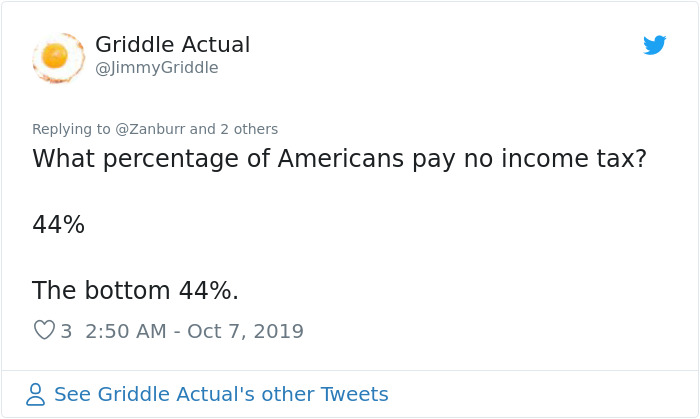

Image credits: JimmyGriddle

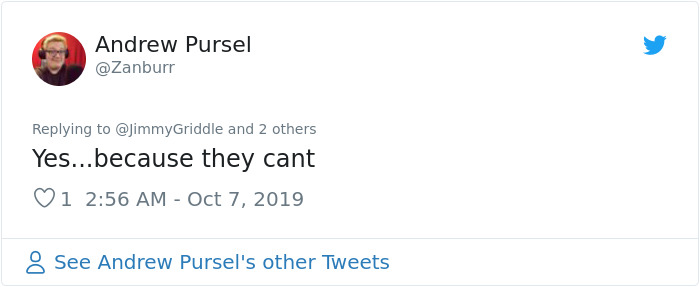

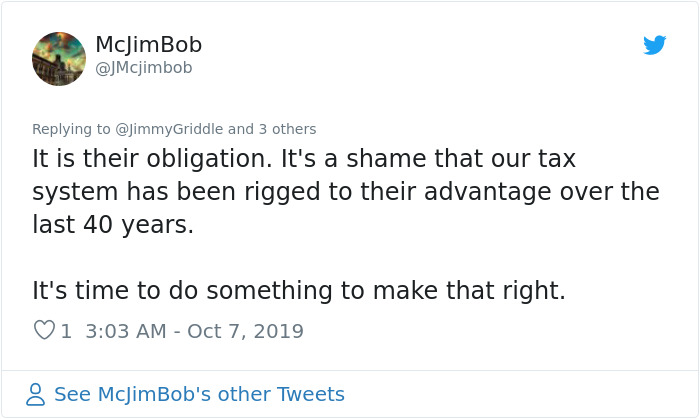

Image credits: Zanburr

Image credits: JimmyGriddle

Image credits: JMcjimbob

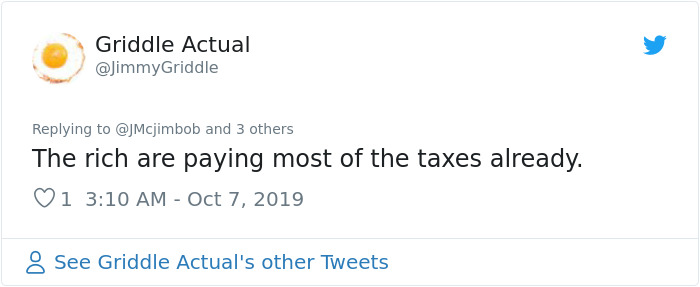

Image credits: JimmyGriddle

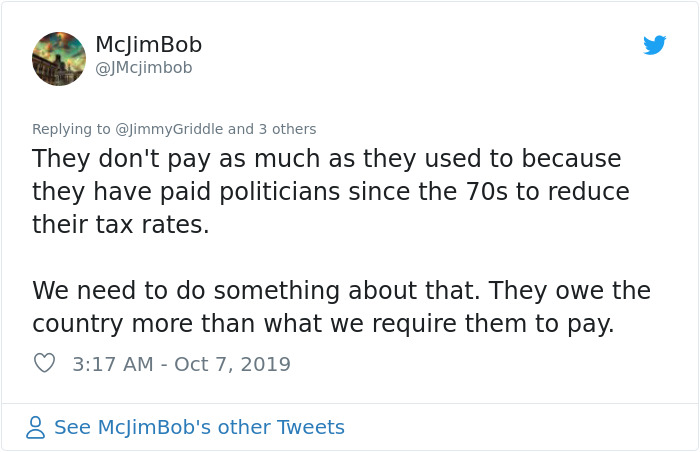

Image credits: JMcjimbob

from Bored Panda https://ift.tt/35gRK5D